Bill Janeway on Who Should Be in Control

Today: A veteran venture capitalist’s insights on why a founder’s control shouldn’t be entrenched.

The Agenda 👇

The flood of unconventional investors

Looking at the evidence

Dealing with inadequate management

The experience of stress

Preventing startups from going off the cliff

Performing due diligence on investors

The case of first-generation entrepreneurs

An eternal antagonism

Good for innovation?

Tiger Global and their light-touch approach

Recently I was writing about the state of Delaware and its unique corporate law that makes it easier for companies to adjust their governance to specific circumstances, particularly on two fronts: granting equity to employees and allowing founders to stay in control even after they’re diluted in the cap table. I then expanded on these topics in Building Startups Across Borders:

The typical journey of a tech startup from the seed round to the IPO is that the founding team will end up owning 10-25% of the company once it becomes public. However, most successful companies make sure to keep founders in control even once their actual stake goes below a certain threshold. This can only be done if the local corporate law allows for things such as a dual-class of shares—and if, unlike those who shunned Deliveroo’s recent IPO, local investors understand why it’s so critical for founders to remain in control.

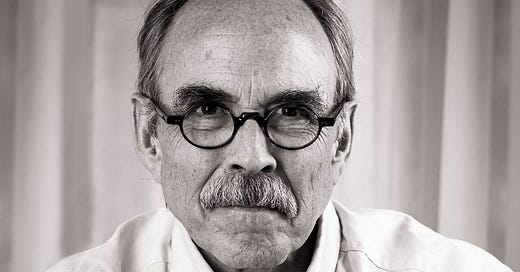

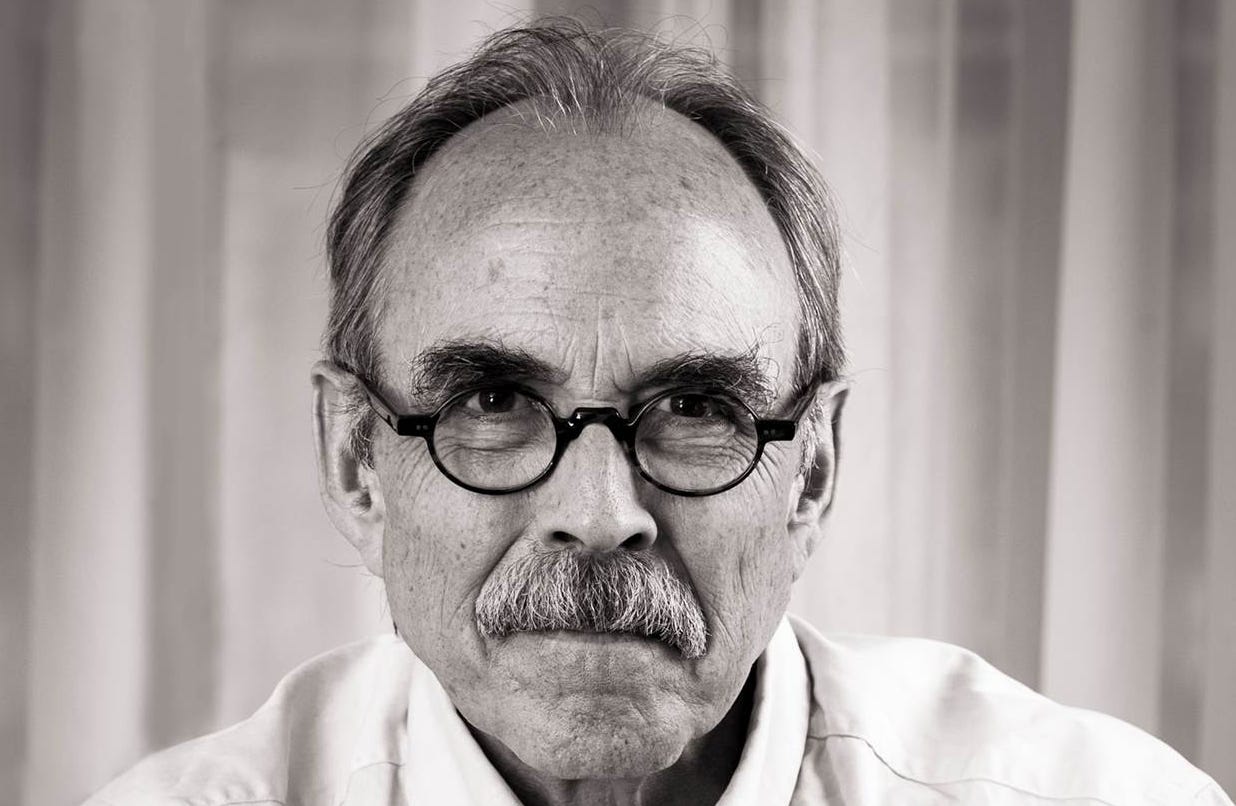

But then my friend Bill Janeway, a member of faculty at Cambridge University and veteran venture capitalist with a long career at Warburg Pincus, read it and sent a rebuttal. Why would I write such a thing? It shouldn’t be a matter of principle that founders stay in control. On the contrary, there are many cases, from Zenefits to WeWork, in which founders in control have run their company into the ground.

Here’s an anecdote about Bill. Three years ago, we hosted him for a fireside chat in Paris to present the 2nd edition of his landmark book Doing Capitalism in the Innovation Economy. We then had a small dinner with Bill and his wife Weslie to which I had also invited local people involved in economic policy and/or venture capital. One of the guests explained that they had recently started their own venture capital firm, and Bill asked: “Well, have you already replaced a failing CEO in your portfolio? If you haven’t, then you’re not a real venture capitalist yet!”

(This person replied that, by coincidence, one of the CEOs in their portfolio was currently transitioning to non-executive chairman—so they were a real venture capitalist, indeed!)

In any case, I expected some pushback on that particular line, and it wasn’t a surprise that it came from Bill. He and I then proceeded to have a conversation about it, and below is my transcript of what Bill said (slightly edited for flow and clarity & I didn’t include my questions, so it’s only Bill speaking from here) 👇

1/ The flood of unconventional investors

In any given venture, both the entrepreneur and the investor are confronted with four dimensions of risk, which have different degrees of uncertainty:

Technology Risk: “When I plug it in, will it light up?”

Market Risk: “Who will buy it if it does work?”

Financing Risk: “Will the capital be there to fund the venture to positive cash flow?”

Business (or Management) Risk: “Will the team manage the transition from startup to sustainable business, especially given the challenge of building an effective channel to the market?”

There’s something I call the ‘biotechnology paradox’. As suggested by startups in this field, at the frontier, investors deem Market Risk much more critical than Technology Risk. Specifically, the very low Market Risk and the very high Technology Risk associated with biotechnology ventures hasn’t deterred investors from allocating enormous amounts of money to biotech for more than 40 years.

Public markets, in particular, have been open to supporting companies with zero revenue, and returns to venture capital in the industry are roughly comparable to returns from all other segments, with the usual skew, etc. The reason, obviously, is that in a third-party-payer system, the market is assured for any innovative drug that receives FDA approval, therefore biotech ventures are mostly confronted with Technology Risk, and investors are comfortable with that.

But then there’s also the Financing Risk, which simply recognizes that all investment is taking place within financial environments that evolve and change and that are not in the control of either the entrepreneur or the venture investor.

Today, we happen to be in a regime where there is an overwhelming supply of risk-seeking capital, most of which is coming from so-called “unconventional investors” (private equity firms, hedge funds, mutual funds, SoftBank, etc.). I haven’t looked yet at the quarterly report issued by PitchBook & the National Venture Capital Association that just came out, but over the last five years, more than half of the amount of venture capital deployed in the US entrepreneurial ecosystem has been coming from these unconventional investors.

Such investors are accepting illiquidity and paying very high prices, all with no ability to change their minds. These are typically public market investors who tend to take liquidity for granted, and yet in this case, even though they are giving up liquidity, by and large, they are not gaining any governance rights! As a result, the balance of power between entrepreneurs and investors has shifted.

Actually the balance of power was already shifting thanks to the concept of the entrepreneur-friendly venture capital firm, of which, of course, my dear friends at Andreessen Horowitz are the most visible advocates. This trend began well before the flood of unconventional capital into venture.

2/ Looking at the evidence

What we have is a collection of anecdotes: the success of Larry Page and Sergey Brin at Google, the success of Mark Zuckerberg at Facebook, and the fact that both companies were originally backed by venture capitalists, very much professionals in each case, who decided to honor the founders’ determination to be entrenched in control. These are enormously successful companies indeed.

But then we also have WeWork and Theranos. In fact, we have many, many startups that have failed and in which founders were also entrenched in control. So all in all, we have dueling anecdotes.

About that, there’s a brand new NBER working paper by Dhruv Aggarwal, Ofer Eldar, Yael Hochberg & Lubomir P. Litov that is looking at the rise of dual-class stock IPOs. The authors conducted an econometric analysis which regresses the increase in the number of dual-class IPOs on venture capital invested in the companies in the recent past.

What they conclude is that the entrenchment of founder control all the way to the IPO is due to two things: “Increased willingness by venture capitalists to accommodate founder control” at the earlier stages, and “technological shocks that reduced firms’ needs for external financing” (the rise of open source software and cloud computing, which reduces the amount of capital required to start and grow a company). In other words, founders raise less capital relative to previous generations, and they raise it from more accommodating venture capitalists.

In addition, the authors found that foreign firms that list in the US, “primarily those based in China, are much more likely to be controlled by founders and have a larger wedge between founders’ voting and economic rights.”

What the authors want to know is your question exactly: Does entrenchment of founders’ control lead to more successful startups? This is a first step to doing a serious independent analysis—and they’ve indicated that a second paper is coming that will focus on patent activity by firms with dual-class shares.

3/ Dealing with inadequate management

Obviously, what you see depends on where you sit. In my own 35-year experience (what I call my ‘sabbatical in venture capital’), anecdotal as it necessarily is, again and again I’ve seen this issue: the adequacy of management (Business Risk) is the dominant risk to which a startup is exposed.

I have this phrase I used to use: It’s amazing what first-class management can do with a second-class idea, but there is no idea so good that it can’t be destroyed by inadequate management. And it is the case in more than several salient examples, a couple of which are detailed in my book, that changing management was the essential step towards creating a really successful, sustainable, valuable business.

Indeed, there were many CEOs whom, over the course of 35 years, I asked to step down. One of them even said to me: “What took you so long?” And he had actually already identified his successor and introduced me to him, and his successor transformed the business into a really successful public company which was then merged with another to give birth to one of the great infrastructure software companies of the 1990s, Veritas Software. So that’s my perspective on Management Risk.

4/ The experience of stress

There’s another thing: the experience of stress. In BEA Systems, a company we invested in and became a huge success, and where we didn’t fire the founders, all of the founders had been through a failed startup or a near-death experience of an established company.

By the way, this is usually omitted in the mythic histories of Silicon Valley, but circa 1990, both Sun Microsystems and Oracle each almost went bankrupt. The truth is, building a really substantial business at a fast pace is extremely stressful, and understanding how people have been able to learn from that explains why some founders succeed against all odds.

Because it’s not only about the importance of cash and control (more on that below), it’s also about “corporate happiness as positive cash flow”, to echo my mentor Fred Adler. What it refers to is the importance, particularly for visionary technologists, of internalizing the question of how to maintain continuity. It’s about how you address what Hyman Minsky always referred to as the “survival constraint”, that is, when you have obligations that you have to meet in cash: you can pay those obligations out of operating revenues, out of the sale of assets, or out of the issuance of new securities. And when you run out of those three alternatives, that’s when you call in the lawyers!

And so this is my concern with the entrenchment of founders: in my experience, unless they have previously been through a failed startup or at least the near-death experience of an established business (that is, flirted with bankruptcy), they are insensitive to those stressors. And that’s the problem in the current environment: there’s no need for them to be sensitive! But I find it extraordinarily unlikely that the current environment will last indefinitely.

There are things that you know will eventually happen, but you have no idea when, and this is one of them. When will interest rates normalize? When will the regulatory regime change? For example, we’ve just seen that the SPAC phenomenon has been whacked by the US Securities and Exchange Commission. What the SEC essentially said is: “If it walks like an IPO and it talks like an IPO and it quacks like an IPO, guess what? We’re going to treat it like an IPO!” And that means it’s going to be subject to the same regulatory requirements, and it’s going to be exposed to the litigation that surrounds the deployment of forward-looking statements in the context of an IPO. It’ll be interesting to see how that plays out.

5/ Preventing startups from going off the cliff

Now, there are entrepreneurs that have been founders and who, for one reason or another, even without having been through a failed startup, even without having been through a near-death experience, are sensitive to the fact that there’s an initial Financing Risk that goes with building a business from scratch. They come to that realization either by themselves or, more likely, in partnership with other members of their management team or with a venture capitalist who can play that partnering role. Indeed, the late Lionel Pincus used to say that our job is to serve as a big brother, a Dutch uncle, a rabbi, a priest for entrepreneurs who are fairly far out on the spectrum of human behavior.

I once went through the experience of having made an investment in an ill-equipped vehicle whose shares we couldn’t sell, and found myself sitting in the back seat with no access to the steering wheel while watching the driver take the car off the cliff. Having been in that position once, I became determined to do whatever I could never to be there again. And that’s my perspective on sharing authority and control: I’d think that idea of not going off the cliff really should appeal as much to entrepreneurs as it does to venture capitalists.

I’ll add to that the idea of cash and control. This means, when some bad and unexpected happens, the importance of having unequivocal access to enough cash to buy the time to investigate and determine the cause of the problem, and then having enough control to be able to impact the terms of the problem. That could mean repurposing the technology, gaining market access by an acquisition, seeking a merger or a sale, or changing leadership. Those are the available alternatives in response to an adverse shock.

As an illustration, note the fact that Benchmark Capital, the extraordinarily successful VC firm founded 25 years ago, twice (in Uber, and in WeWork) found itself in the position of having to shoot itself out of an illiquid investment where extraordinary governance rights had been granted to the founders. That is an anecdote that I think we should all bear in mind.

6/ Performing due diligence on investors

The fact that a founder is willing to share control doesn’t mean they should share it with anyone. It’s really up to entrepreneurs to do their due diligence on the investors they get on board. Venture capitalists have track records. Some of them are ignorant or stupid, some of them are bullies, some of them behave badly. This should not be a surprise. It’s possible that a naive first-time entrepreneur might not know how or have the network to do effective due diligence. But it’s out there waiting to be done.

About that, let me just say one thing about venture capital that’s really different. It’s not the extremely skewed returns: we see that across various asset classes. Rather, it’s the persistence of a firm’s returns over several decades, as seen in the US and documented with the data provided not by venture capitalists themselves, but by their limited partners!

So I don’t think there’s any excuse, certainly not in the US, for entrepreneurs not to have a look at an investor’s track record. I’m sure the data in Europe is still not as good: you don’t have anything like the data that’s been analyzed in the definitive US studies of venture capital returns as measured by limited partners—net of fees, net of carry. But still, there’s enough experience in venture capital over the course of more than 20 years, one would think, to allow for entrepreneurs to do some degree of due diligence by talking to their peers.

7/ The case of first-generation entrepreneurs

The idea that founders should be entrenched was absolutely not present in the early generations of tech entrepreneurs in the US, going back to the 70s and through the 80s. Bill Gates had no special governance rights. Steve Jobs, who was famously fired by his board, had no special rights, either. Nobody did. Jimmy Treybig at Tandem Computers did not. Fred Smith at FedEx did not. These were the great startups of the 1970s, back when professional venture capital was still a kind of craft industry.

Another interesting case is Larry Ellison of Oracle. He managed to retain very substantial control by generating revenues really early thanks to the extraordinarily powerful sales machine at Oracle. As a result, he effectively had absolute control of his board with only partial ownership, all with his governance rights matching his economic interests—again, no special treatment!

So I wouldn’t say I would rule it out, but I’m not aware of a visibly successful tech venture backed by first-class, professional venture capitalists that agreed to entrench management before Google. The structure of dual-class shares was known in the media industry, at outlets such as The New York Times or The Wall Street Journal. But that was to preserve editorial independence, not to entrench the management.

And so, in a way, Google opting for a founder-friendly governance and later a dual-class structure as a public company seems to be the foundational event that inspired others, including Mark Zuckerberg at Facebook. I wasn’t present, so I don’t know how Larry Page and Sergey Brin did it. They had no revenue, and yet they managed to negotiate their entrenchment with two of the best venture capitalists in the history of capitalism, John Doerr at Kleiner Perkins and Mike Moritz at Sequoia.

Again, I wasn’t present, I know nothing beyond what I’ve read in the books that were written about it, but the early investors obviously agreed. And this happened in 1998-1999, at the peak of the dotcom bubble, so I’m sure in that particular context there were some other cases, but they sort of vanished. Just as today, there was a flood of risk-seeking capital pouring into startups.

(At the time, as an investor at Warburg Pincus, I had personally decided it was a policy matter not to invest in any of the dotcom startups—so there may well have been dotcom startups that had dual class stocks, I don’t remember, but I didn’t really have a look at these at the time.)

8/ An eternal antagonism

There is a long history of tension and antagonism between entrepreneurs and financiers. For instance, you’re probably aware that Henry Ford hated Wall Street. It wasn’t just because there were Jews on Wall Street, even though he hated Jews; he really did hate Wall Street financiers irrespective of religion or ethnicity. And as soon as he could, he bought back the investments made by outside financiers in the Ford Motor Company. Only after Ford’s death did the company go public on Wall Street.

J.P. Morgan, on the other hand, was effectively responsible for firing Thomas Edison from Edison Electric, a company which eventually became General Electric.

So we can go way back before the rise of professional venture capital. If you track the history of people like Walter Chrysler, the last entrepreneur to create an independent automobile company in the United States before Elon Musk, you learn a lot of things about this landmark industry, and you realize there were many wars around the management, leadership, ownership of General Motors, for instance, and between General Motors and its investors. So in one sense, there’s sort of nothing new in this.

9/ Good for innovation?

I do think that the issues that are in this paper by Aggarwal et al., whether it’s the supply of capital or the capital intensity of the venture, are both important in understanding what the balance of power is.

But my point of view is orthogonal to that. From my perspective as an investor, the central issue is to integrate into the core of the business the imperative to follow the cash and think in terms of Financing Risk. To use a mathematical concept, the ability of a founder to be in control is the dot product of their ability to meet their promises to investors over time and the evolving availability (and, therefore, cost) of capital.

On the other hand, the freedom to be entrepreneurial by entrenching a founder’s control from a governance perspective seems totally irrelevant to me. It didn’t make a difference in the past, and it won’t make a difference in the future.

The fact of the matter is this: I’m not susceptible to the cult of the entrepreneur. I just gave a talk to a group of entrepreneurs at Cambridge University, and the second slide after the one about the dimensions of risk was about the fact that all entrepreneurs lie. When you have this kind of determination to change the world, and the world pushes back, well, there can be, let us say, less than full disclosure of shortcomings and shortfalls.

And that’s where following the cash is how you can adjust for that from an investor’s perspective. It is fair to say, I think, that the entrepreneurs who really get you in trouble are the ones who don’t know they’re lying. But you know, at some point we get to the end of that day. As an outsider watching purely from afar, I think that there was probably an extended period of time when Elizabeth Holmes (of Theranos) and Adam Neumann (of WeWork) didn’t know they were really lying. But there had to come a time when they did.

In the end, it’s all about balancing power rather than choking off the entrepreneurial drive and vision. Greedy venture capitalists who abuse entrepreneurs are not likely to find that they have the opportunity to invest more or with better entrepreneurs in the future. There is a reputational risk that goes around pretty quickly. And I’m sure even with the issues of fragmentation in Europe, word gets around.

10/ Tiger Global and their light-touch approach

I used to know a guy who was a professional non-executive director of the sort of public company whose headquarters are in the Cayman Islands. And here’s what he used to say about the minority shareholders of the public companies of which he was a director: “Had God not made them sheep, they would not have been born to be shorn.”

(This, by the way, is typically applied to the sort of retail investors you find trading on Robinhood these days.)

And so, you know, investors like Tiger Global appear and disappear in every cycle, illustrating the oldest line in the book of financial markets: “Everyone’s a genius in a bull market”. I have no idea what Tiger Global’s returns are, but this much I know: making illiquid investments with minimal due diligence and zero concern for governance is not a formula for long-term investment success.

If you enjoyed this edition of European Straits, you should subscribe so as not to miss the next ones.

From Munich, Germany 🇩🇪

Nicolas